Going through a bankruptcy, either personally or with your business, can affect your ability to qualify for a mortgage. Your credit score may drop, and you may need to wait before applying for a home loan. It all depends on the size of your down payment a

Feb 27, 2019 | Home Buying or Selling Credit

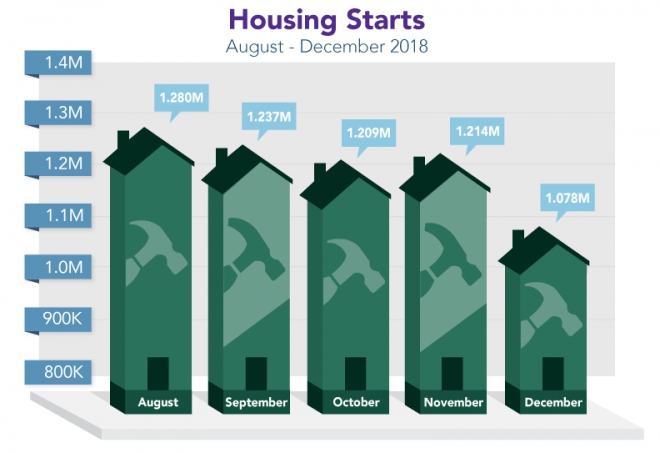

Delayed December Housing Starts fell 11.2% from November to an annual rate of 1.078 million units versus the 1.254 million expected. It was the slowest pace since September 2016. Building Permits were essentially unchanged at 1.326 million versus the 1.29

Feb 26, 2019 | Mortgage News

When you need a chunk of cash for a project, your home may be the best source of funding. Fortunately, you do not need to sell your home to take advantage of your equity. There are two popular and practical ways to pull cash out of your home: a cash-out r

Feb 20, 2019 | Refinancing a Home Home Equity Loans

Have you ever had a jingle stuck in your head? Or perhaps you’re familiar with a slogan that you could start reciting and 90% of people could finish? How do so many major brands manage to get their message stuck in our heads? You may have noticed,

Feb 18, 2019 |

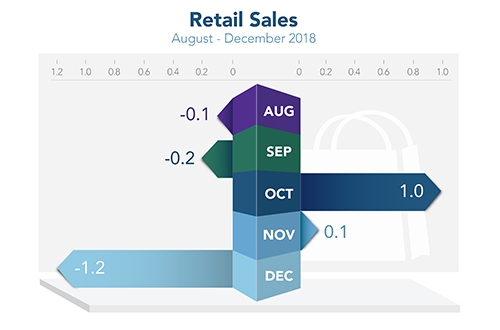

'Only got twenty dollars in my pocket' ...Thrift Shop by Macklemore & Ryan Lewis. The financial markets are sensing a government shutdown and protracted trade war with China will be averted. This is good news and a reason why Stocks have cont

Feb 14, 2019 | Mortgage News

You have found your dream house but it will take significant work to make it a home. You do not have cash in savings to pay for both a down payment and the repair costs. Can you get a home loan in Utah when buying a fixer-upper? Not to worry - this is not

Feb 13, 2019 | FHA Loans Conventional Loans Purchasing a Home