Once you get serious about buying a home or refinancing your current mortgage, you will probably hear the term “loan-to-value ratio” mentioned by your mortgage broker. What is this ratio and how does it affect your Utah mortgage? Loan-to-Value Ratio De

Jul 10, 2019 | Credit Mortgage Basics Purchasing a Home Refinancing a Home

U.S. military veterans can now apply for VA mortgage loan that now exceeds the conforming loan limit set by the Federal Housing Finance Agency (FHFA). The Blue Water Navy Vietnam Veterans Act, unanimously approved by the Senate and signed into law Tu

Jul 08, 2019 | VA Loans

Mortgage refinance loans require fees and closing costs. Is there a way around those fees? Is it possible to refinance without paying closing costs? The answer is yes, although the rest of your loan will be affected. The typical fees associated with refi

Jun 26, 2019 | Homeowner Tips

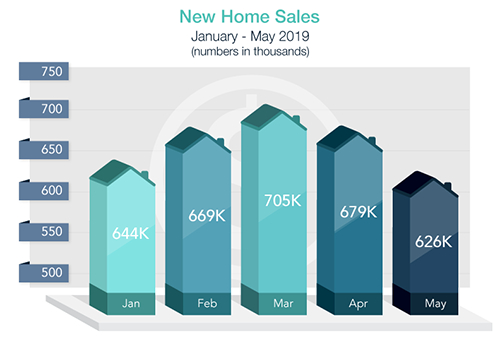

May New Home Sales Disappoint Sales of new homes fell by nearly 8% in May from April by to an annual rate of 626,000 units, below the 683,000 expected. From May 2018 to May 2019, sales declined 3.7%. Inventories are now just above normal rates of 6 month

Jun 25, 2019 | Mortgage News

Adding real estate to your investment portfolio can be a great asset… if done correctly. Buying a property to flip or rent out has different mortgage requirements than a primary residence. There are always hidden costs that need to be anticipated a

Jun 19, 2019 | Home Buying or Selling

Private mortgage insurance (PMI) is typically required by mortgage lenders when borrowers contribute less than 20% of the home’s value as a down payment. This insurance protects the lender, not the homebuyer. If the loan borrower defaults on the mor

Jun 12, 2019 | Conventional Loans