Your credit score is an essential factor in determining much about any mortgage loan you receive. A credit score is a measure of your trustworthiness as a borrower. It pays to know as much about your credit score as possible before applying for home loan

May 01, 2019 | Credit

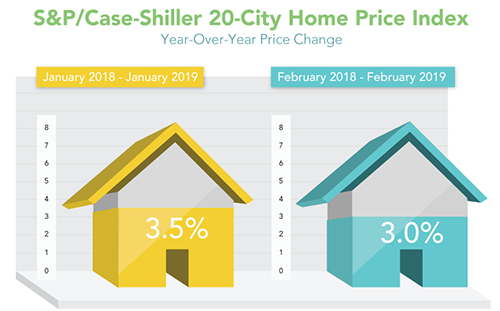

Home price gains continue to cool as they drift down to more normal levels due in part to an uptick in housing inventories. The S&P Case-Shiller 20-City Home Price Index rose 3% from February 2018 to February 2019, up 0.2% from January to February. Th

Apr 30, 2019 | Mortgage News

While it is possible to get into homeownership with little upfront investment, there can be many benefits to building up equity in a property. Mortgage equity is the value of the homeowner’s stake in a home. It is basically how much the home is wort

Apr 24, 2019 | Homeowner Tips

When you are ready to apply for a mortgage loan, your mortgage broker will ask you for all sorts of financial information. One of the things lenders do with this data is to calculate your debt-to-income (DTI) ratio. A DTI ratio is one of the most basic me

Apr 17, 2019 | Credit Mortgage Basics

Initial Jobless Claims is a weekly report that tracks how many people have filed for unemployment benefits. It is both a solid gauge on the state of the labor market and economy and a leading indicator on what to expect in the months ahead. So, what are

Apr 12, 2019 | Mortgage News

4 Simple Ways to Get - and Benefit from - Client Feedback These days, getting feedback from your clients is often just an email, web form or social media post away. Before feedback gets buried in your inbox or lost in your feed, grab it and grow from it.

Apr 12, 2019 |